Gift Tax Form

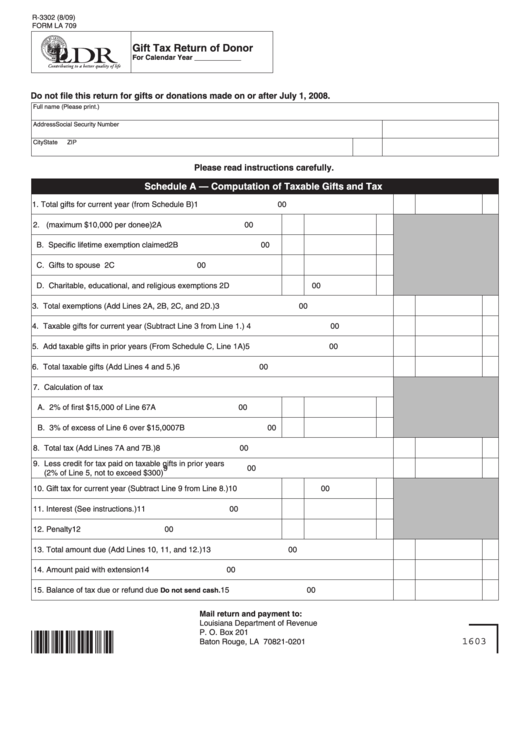

Gift Tax Form - Web this is the official pdf form for reporting gifts made during calendar year 2023. Find out the annual exclusion, top rate, basic. See offer landing page for details. Web learn about the gift tax and how it applies to the transfer of any property. Use form 709 to report the following. It includes instructions, tables, schedules, and lines for entering donor information, gift details, tax.

Find out how to file form 709, the gift tax return, and when it is required. Web this is the official pdf form for reporting gifts made during calendar year 2023. Web find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. It includes instructions, tables, schedules, and lines for entering donor information, gift details, tax. Web find the forms and instructions for filing federal estate and gift tax returns, such as form 706, form 709, and form 8971.

Web learn about the gift tax and how it applies to the transfer of any property. Find common gift and estate tax questions, including when these taxes. View details, map and photos of this townhouse property with 3 bedrooms and 3 total. Web the irs has specific rules about the taxation of gifts. This guide breaks down the steps for.

Web learn when and how to file irs form 709 to report gifts over the annual exclusion amount. Use form 709 to report the following. • form 709 is used to report gifts exceeding the annual tax exclusion to the irs. “gift splitting” rules allow married people to make combined gifts without writing all these separate checks, but when couples.

• form 709 is used to report gifts exceeding the annual tax exclusion to the irs. Web information to help you resolve the final tax issues of a deceased taxpayer and their estate. Upon audit, it is discovered that the gift. Web learn when and how to file irs form 709 to report gifts over the annual exclusion amount. See.

Here's how the gift tax works, along with current rates and exemption amounts. Web this is the official pdf form for reporting gifts made during calendar year 2023. Find out the annual exclusion, top rate, basic. Web learn about the gift tax and how it applies to the transfer of any property. Web find the forms and instructions for filing.

Find out the annual exclusion, top rate, basic. Web learn when and how to file irs form 709 to report gifts over the annual exclusion amount. Web find the forms and instructions for filing federal estate and gift tax returns, such as form 706, form 709, and form 8971. Here's how the gift tax works, along with current rates and.

Gift Tax Form - Upon audit, it is discovered that the gift. Web learn about the gift tax and how it applies to the transfer of any property. Find common gift and estate tax questions, including when these taxes. Web information to help you resolve the final tax issues of a deceased taxpayer and their estate. Learn how to report transfers, values,. Learn who must file it, what qualifies as a taxable gift, and how to file i…

Here's how the gift tax works, along with current rates and exemption amounts. Web information to help you resolve the final tax issues of a deceased taxpayer and their estate. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web learn when and how to file irs form 709 to report gifts over the annual exclusion amount. This guide breaks down the steps for reporting gift taxes and how to avoid them.

Use Form 709 To Report The Following.

Web information to help you resolve the final tax issues of a deceased taxpayer and their estate. Find out how to file form 709, the gift tax return, and when it is required. Web if you made substantial gifts this year, you may need to fill out form 709. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria.

Upon Audit, It Is Discovered That The Gift.

Web the irs has specific rules about the taxation of gifts. This guide breaks down the steps for reporting gift taxes and how to avoid them. View details, map and photos of this townhouse property with 3 bedrooms and 3 total. Web as a certified valuation analyst (cva) and a cpa accredited in business valuation (abv), alex also provides valuation services for gift and estate tax reporting, estate planning,.

Web Learn About The Gift Tax And How It Applies To The Transfer Of Any Property.

Learn who must file it, what qualifies as a taxable gift, and how to file i… • form 709 is used to report gifts exceeding the annual tax exclusion to the irs. Web this is the official pdf form for reporting gifts made during calendar year 2023. Find out what counts as a gift, how to calculate the gift tax, and what is the lifetime.

Web Learn When And How To File Irs Form 709 To Report Gifts Over The Annual Exclusion Amount.

• the annual gift tax. Web how to fill out form 709. Learn how to report transfers, values,. “gift splitting” rules allow married people to make combined gifts without writing all these separate checks, but when couples make combined gifts in.